Checking Your FESCO Bill History and Previous Records

Managing electricity bills is no longer just about paying on time. Today, consumers also need accurate billing records for tax, auditing, and personal finance purposes. One document that has gained importance in recent years is the fesco withholding tax certificate. Whether you are a salaried person, business owner, or filer, understanding your FESCO bill history helps you stay compliant and financially organized.

In this detailed guide, you will learn how to check FESCO bill history, track previous records, and understand the role of the fesco withholding tax certificate. This article is written to help Pakistani electricity consumers with practical, real-world guidance in simple language.

Understanding FESCO and Its Billing System

Faisalabad Electric Supply Company, commonly known as FESCO, supplies electricity to Faisalabad and surrounding districts. Its billing system records monthly consumption, taxes, surcharges, and adjustments. These records become critical when you need proof of paid taxes or past electricity usage.

Every electricity bill issued by FESCO contains multiple tax components. One of these is withholding tax, which is charged under Pakistani tax laws. This is where the fesco withholding tax certificate becomes important for tax filers.

What Is a FESCO Withholding Tax Certificate?

A fesco withholding tax certificate is an official document that confirms the amount of withholding tax you have paid through your electricity bills. This tax is collected on behalf of the Federal Board of Revenue. For income tax filers, this amount can often be adjusted or claimed during annual tax returns.

Many consumers are unaware that their electricity bill serves as proof of tax payment. However, without proper bill history and records, it becomes difficult to calculate or verify paid withholding tax.

Why Checking FESCO Bill History Matters

Checking your previous electricity bills is not only helpful but sometimes necessary. Your bill history acts as evidence of payments, consumption trends, and taxes deducted.

When you review past bills, you can confirm whether withholding tax was applied correctly. This ensures accuracy when requesting or calculating your fesco withholding tax certificate. It also helps resolve disputes with FESCO or landlords, especially in shared properties.

How to Access Your FESCO Bill History Online

FESCO has made it easier for consumers to access their billing information online. By using your reference number, you can view current and previous bills without visiting an office.

For most users, the easiest method is through the FESCO Online Bill Check option available on trusted platforms. This allows you to view detailed bill data, including units consumed, taxes applied, and total payable amounts. You can explore this option here: FESCO Online Bill Check

Once you access your bill, you can save or print it for future use. These saved bills become your personal archive and support your fesco withholding tax certificate calculations.

Checking Previous Records for Tax Purposes

Previous records are especially important for tax filers. Electricity withholding tax is charged if your monthly bill crosses a certain threshold. Over a year, this amount can become significant.

By reviewing your past bills, you can total the withholding tax paid. This total is often required when filing annual tax returns. Without accurate records, taxpayers may lose the benefit of adjustments.

This is why professionals recommend keeping at least one year of FESCO bill history. Digital copies are acceptable and often easier to manage.

Linking Electricity Bills with Tax Filing

In Pakistan, electricity bills are directly linked to income tax compliance. Non-filers are charged higher withholding tax rates on utility bills. Filers benefit from lower rates and adjustment options.

Your fesco withholding tax certificate essentially proves that tax was already deducted. When filing returns, this helps reduce overall tax liability. Accurate bill history ensures that the figures you declare match official records.

Tax consultants often request copies of previous bills. Having quick access to your online bill history saves time and avoids errors.

Common Issues While Checking FESCO Bill History

Some users face difficulties while checking old bills online. These issues may include incorrect reference numbers, website downtime, or missing older records.

In such cases, consumers can contact FESCO customer service or visit the nearest office. Carrying a printed or digital copy of recent bills usually helps resolve issues faster.

Keeping a personal archive also protects you if online records are temporarily unavailable.

Using Online Platforms for Bill Records

Besides official portals, several reliable websites help consumers check bills easily. These platforms offer fast access and user-friendly interfaces.

For general electricity bill services, you can also use the Online Bill Check feature available here: Online Bill Check

Such platforms are helpful when official systems are slow. They allow consumers to stay updated without technical complications.

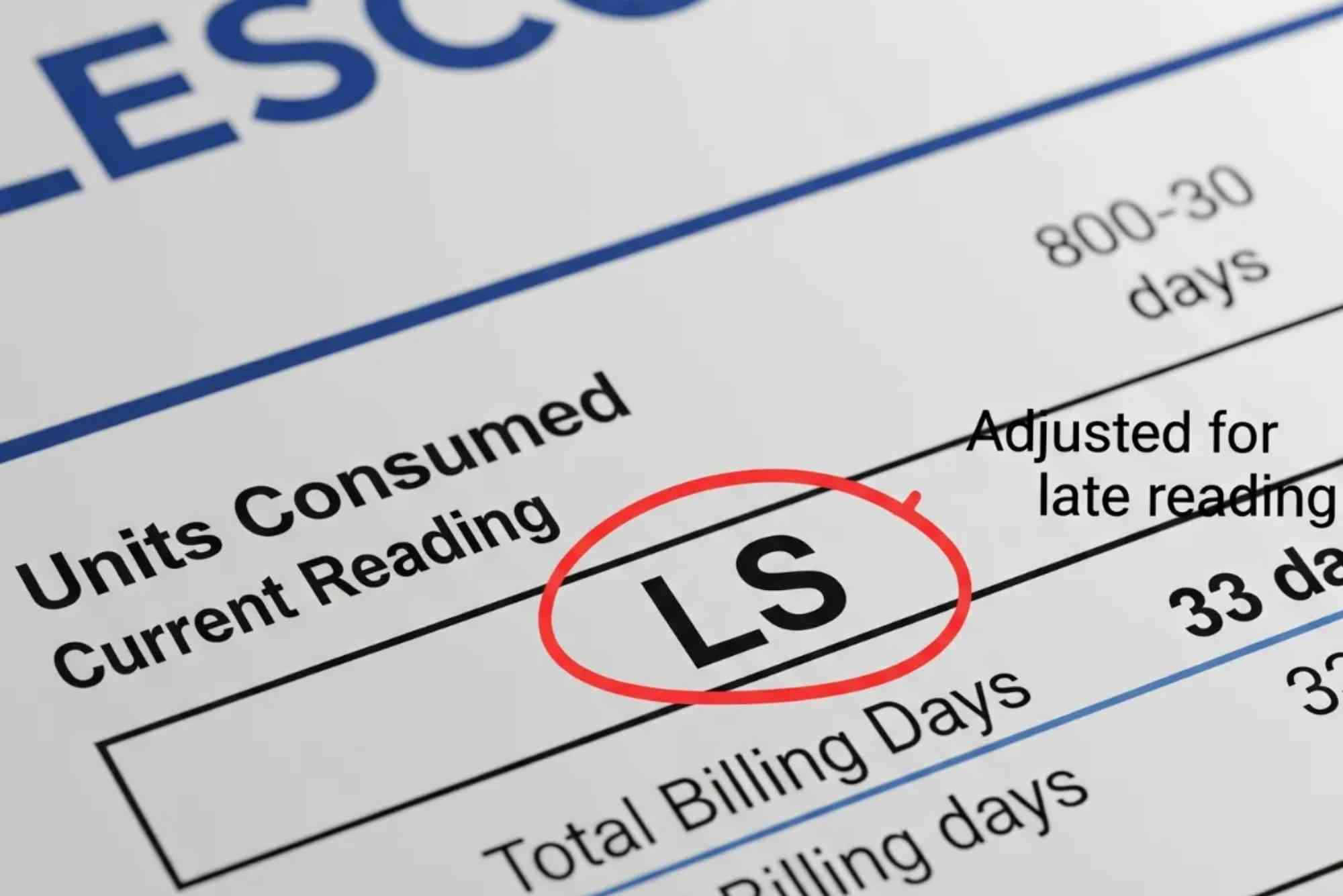

Understanding Withholding Tax on FESCO Bills

Withholding tax on electricity bills applies when the monthly amount exceeds a specified limit. The rate varies for filers and non-filers.

This tax is not optional. It is deducted automatically and transferred to the tax authorities. Your fesco withholding tax certificate confirms this payment.

Understanding how this tax works helps consumers plan better. It also encourages tax registration, as filers pay lower rates.

How Businesses Benefit from Bill History Records

For businesses, electricity bills are part of operational expenses. Previous records help in budgeting, auditing, and tax compliance.

Businesses often require a fesco withholding tax certificate to reconcile accounts. Auditors may ask for proof of tax deducted at source. Accurate bill history ensures smooth audits and avoids penalties.

Digital access to previous records has made this process more efficient for small and medium enterprises.

Avoiding Errors and Mismatches

Errors in bill records can create problems during tax filing. Sometimes, withholding tax may appear incorrect due to outdated filer status.

By checking bill history regularly, consumers can identify such issues early. Updating tax filer status with authorities often resolves higher deductions.

Keeping track of changes ensures that your fesco withholding tax certificate reflects correct amounts.

Best Practices for Managing FESCO Bill Records

Managing electricity records does not require complex systems. Saving monthly bills in a dedicated folder is enough.

Labeling files by month and year improves organization. This habit proves useful during tax season or financial reviews.

Consistent record keeping supports accurate calculation of withholding tax and reduces dependency on external sources.

FAQs

How can I get my fesco withholding tax certificate?

You can calculate it using your paid electricity bills. The withholding tax amount is mentioned on each bill.

Is withholding tax refundable?

For income tax filers, withholding tax can often be adjusted against annual tax liability.

How far back can I check my FESCO bill history?

Online systems usually show recent months. Older records may require contacting FESCO directly.

Do non-filers pay more withholding tax?

Yes, non-filers are charged higher rates on electricity bills.

Are online bill copies valid for tax purposes?

Yes, printed or saved online bills are accepted as proof of payment.

Checking your FESCO bill history is more than a routine task. It plays a vital role in financial planning and tax compliance. By maintaining accurate records, you can confidently calculate your fesco withholding tax certificate and avoid unnecessary tax burdens.

Digital tools have made this process simple and accessible. Make it a habit to review and save your electricity bills every month. This small step can save time, money, and stress in the long run.

Start today by checking your latest bill online and organizing your previous records. Staying informed keeps you in control of your finances and compliant with tax regulations.