Complete Guide to Fesco Tax Certificate (FESCO)

Understanding your electricity bills and the taxes associated with them is essential for every consumer in Pakistan. For FESCO (Faisalabad Electric Supply Company) customers, the Fesco Tax Certificate plays a vital role in managing payments, taxes, and business documentation. Whether you are a residential user or a business owner, knowing how to obtain and use the Fesco Tax Certificate can save you time, prevent confusion, and ensure compliance with local tax regulations. This comprehensive guide explains everything you need to know about the Fesco Tax Certificate.

What is a Fesco Tax Certificate?

A Fesco Tax Certificate is an official document provided by FESCO that confirms the taxes you have paid on your electricity consumption. This certificate is often required for accounting purposes, tax filing, and business record keeping. For businesses, it can serve as proof of paid utility taxes, which may be necessary for financial audits or government submissions.

The certificate includes essential information such as the consumer account number, payment history, tax amount, and the period covered. Having this certificate ensures that your payments are transparent and recognized by relevant authorities.

Importance of Fesco Tax Certificate

Obtaining a Fesco Tax Certificate is not just a formality; it has multiple advantages:

Proof of Tax Payment

The certificate acts as an official confirmation that the taxes on your electricity bills have been paid. This is particularly useful for businesses that need to maintain accurate records for tax compliance.

Simplifies Tax Filing

For individuals and companies, the certificate can be used to declare electricity-related taxes during annual tax filings. It eliminates the need to manually calculate or gather old bills.

Business Documentation

Many businesses require utility tax certificates as part of financial audits or accounting records. Fesco Tax Certificate provides a reliable document for such purposes.

Resolving Billing Disputes

If there is any confusion or dispute over electricity payments or tax charges, the certificate serves as proof of payment and helps resolve issues efficiently.

How to Apply for a Fesco Tax Certificate

Applying for a Fesco Tax Certificate is a straightforward process, and it can be done either online or in-person at FESCO offices.

Online Application

FESCO has simplified the process with online services. To apply online, you need to visit the official FESCO website or trusted portals. Here is how you can proceed:

- Visit the FESCO online portal.

- Log in with your account number and relevant details.

- Navigate to the “Tax Certificate” section.

- Fill in the required information, including billing period and personal details.

- Submit your request. The certificate is usually delivered electronically or can be downloaded as a PDF.

For easier bill management and verification, you can also use FESCO Online Bill Check to confirm your payment history before applying for the certificate.

Offline Application

If you prefer a manual approach:

- Visit the nearest FESCO office.

- Fill out the tax certificate application form.

- Provide your electricity account details and recent bill receipts.

- Submit the application and wait for the certificate issuance.

Offline processing might take longer, so online applications are recommended for faster results.

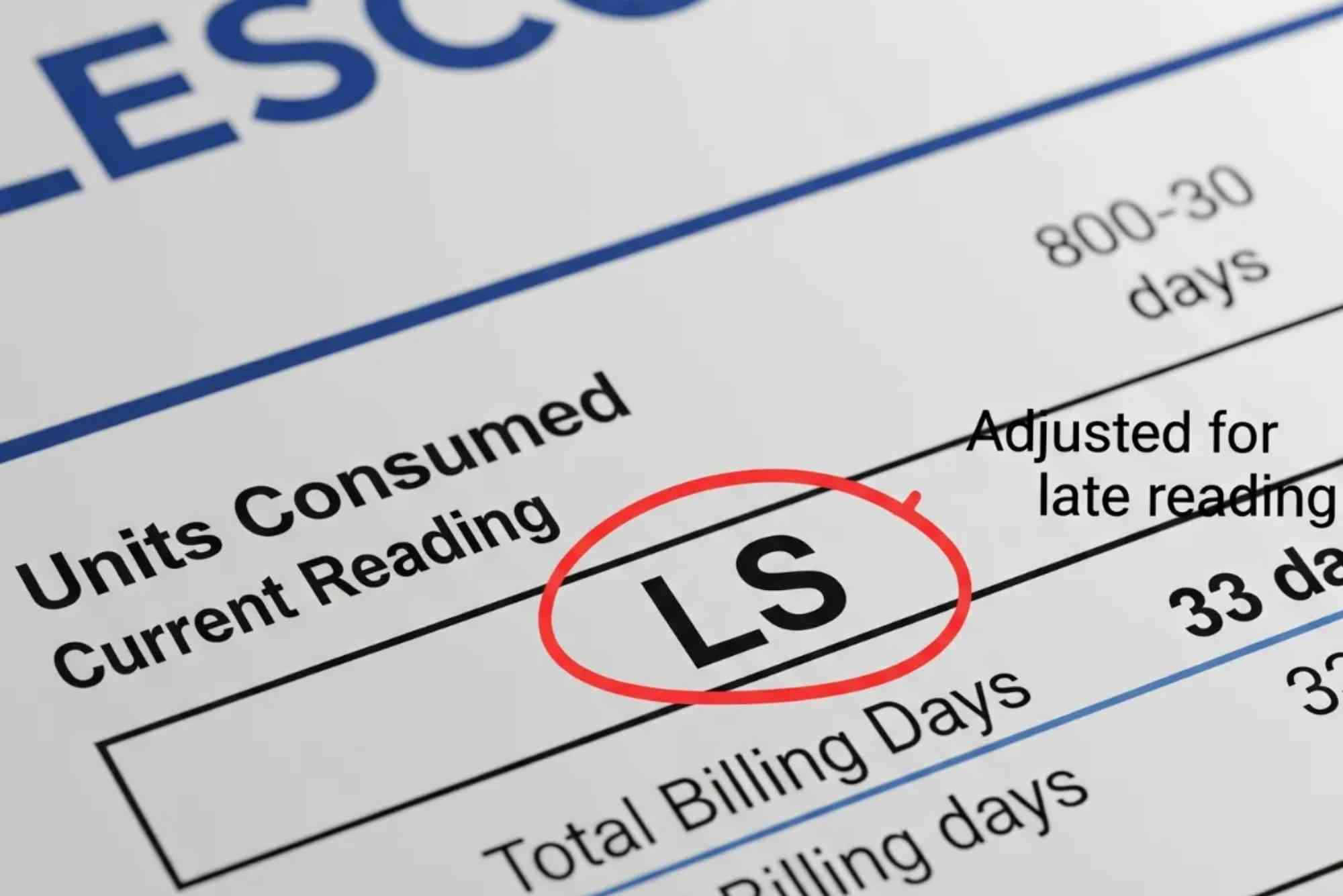

Key Details Included in a Fesco Tax Certificate

Understanding the content of the certificate is crucial to ensure accuracy. A typical Fesco Tax Certificate includes:

- Consumer account number

- Name and address of the account holder

- Billing period covered by the certificate

- Total electricity charges paid

- Tax amount paid and applicable rates

- Issuing date and official signature

Always check the certificate for accuracy, as discrepancies can cause problems with tax filings or business documentation.

How to Check Your FESCO Bill Online

Before applying for a tax certificate, it’s advisable to verify your billing records. FESCO provides a convenient Online Bill Check service, which allows customers to review current and past bills.

Steps to Check FESCO Bill Online:

- Visit the official FESCO bill check portal.

- Enter your account number or customer ID.

- Review your billing history, including electricity usage and taxes paid.

- Download or print the bill for your records.

Regularly checking your bills online ensures transparency and helps in generating accurate tax certificates.

Common Issues and How to Resolve Them

While the Fesco Tax Certificate process is smooth, some customers may encounter issues. Common problems include:

- Incorrect Account Information: Ensure the account number and details entered match FESCO records.

- Delayed Certificate Issuance: Online requests are faster; offline requests may take longer due to office processing time.

- Billing Discrepancies: Always cross-check your online bill before applying for a certificate.

Contacting FESCO customer support can quickly resolve most issues.

FAQs

What is the Fesco Tax Certificate used for?

It serves as proof of electricity tax payment, essential for tax filings, business documentation, and audits.

How can I get a Fesco Tax Certificate online?

You can apply through the official FESCO portal by logging in with your account details and submitting a request under the “Tax Certificate” section.

Can I use a Fesco Tax Certificate for business purposes?

Yes, businesses often use it for accounting records, financial audits, and tax filings.

How long does it take to receive the certificate?

Online applications are typically processed within a few days, while offline requests may take longer depending on office workload.

How do I check my FESCO bill before applying?

You can use FESCO Online Bill Check or the main Online Bill Check portal to verify your payment history.

Is the Fesco Tax Certificate free?

Generally, applying for the certificate online is free, though some offline requests may include a nominal processing fee.

A Fesco Tax Certificate is more than just a piece of paper; it is a vital document that ensures your electricity tax payments are properly recorded and recognized. Whether for personal tax filing, business accounting, or resolving disputes, obtaining this certificate is a step toward financial transparency and compliance.