Everything About Gepco Income Tax (GEPCO) Address and Contact Information

When it comes to electricity consumers in Pakistan, Gepco income tax is one of the most frequently asked topics. Gujranwala Electric Power Company (GEPCO) serves millions of households and businesses, and like other power distribution companies, it applies government-mandated taxes on bills. Understanding these taxes, along with GEPCO’s address and contact information, helps consumers manage bills correctly and avoid confusion.

In this comprehensive guide, we will cover everything you need to know about Gepco income tax, including why it is charged, where to find official details, and how to contact GEPCO for clarification.

What is Gepco Income Tax?

The Gepco income tax is a government-levied tax applied on electricity bills issued by GEPCO. It is not a GEPCO-imposed charge but a federal tax collected through electricity bills to increase national revenue. This income tax applies differently based on electricity consumption and type of consumer, such as domestic, commercial, or industrial.

Electricity bills often contain multiple charges, including:

- Fuel price adjustments

- GST (General Sales Tax)

- TV license fee

- Income tax

Among these, the income tax often raises questions for consumers who want to know why they are paying it and how it is calculated.

Why Do Consumers Pay Gepco Income Tax?

Income tax on electricity bills is designed to broaden the tax net. Many individuals who are not direct taxpayers contribute through utility bills. This way, the government ensures tax collection from a wider population base.

Domestic users with higher electricity usage, commercial setups, and industrial units generally pay more in income tax compared to small household consumers. The exact percentage or amount is determined by consumption brackets and national tax policies.

How is Gepco Income Tax Calculated?

The calculation depends on several factors:

- Units consumed: Higher usage leads to higher income tax.

- Type of connection: Domestic, commercial, and industrial categories differ.

- Government rules: Tax slabs and percentages may change through federal budget announcements.

For example, a household using less than 200 units may pay a smaller fixed amount, while large consumers or businesses face higher tax rates.

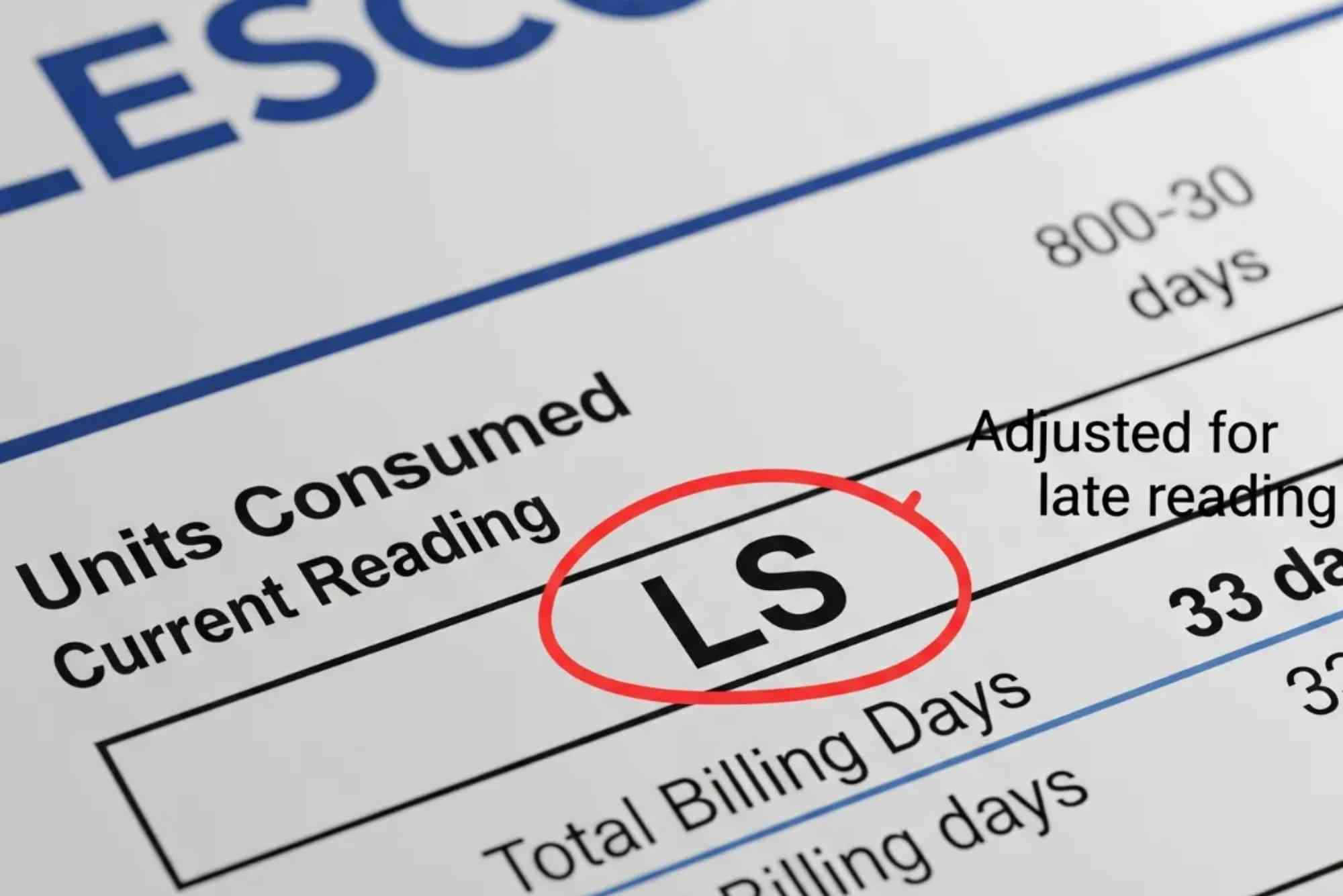

Gepco Income Tax and Your Monthly Bill

Understanding where the income tax appears on your bill is essential. Usually, it is mentioned under the “Government Charges” or “Taxes” section. Consumers should carefully review their bill breakdown to confirm charges.

If you want to verify your bill, you can use online tools like Gepco Online Bill Check or Online Bill Check. These platforms allow you to view and download your bill easily.

GEPCO Address and Contact Information

For consumers who need clarification about their bills or income tax deductions, visiting or contacting GEPCO directly is the best option.

- Head Office Address: GEPCO Headquarter, 565/A, Model Town, G.T. Road, Gujranwala, Pakistan.

- Customer Service Centers: GEPCO has regional offices in Gujranwala, Hafizabad, Sialkot, Mandi Bahauddin, Narowal, and Gujrat.

- Helpline: 118 (available nationwide for electricity-related complaints).

- Alternate Number: 055-9200504

- Email: complaints@gepco.com.pk (for written inquiries and official communication).

Visiting the nearest regional office ensures faster resolution of bill-related disputes, including income tax queries.

How to Contact GEPCO for Income Tax Issues

If you see unexpected income tax charges on your bill, follow these steps:

- Call the helpline at 118 for immediate assistance.

- Email GEPCO with a scanned copy of your bill for review.

- Visit the nearest customer service office with your latest bill.

- Raise a complaint through official GEPCO channels for record-keeping.

Common Issues Consumers Face with Gepco Income Tax

Consumers often report similar challenges:

- Sudden increase in income tax despite stable usage.

- Misclassification of domestic users into higher slabs.

- Confusion over seasonal changes in tax policies.

- Lack of awareness of exemptions for low-income households.

In most cases, these issues can be resolved by reviewing consumption units and consulting GEPCO’s support staff.

Legal Exemptions and Relief on Gepco Income Tax

Some consumers may qualify for exemptions or reduced tax rates. For instance:

- Low-income households consuming below 50–100 units often pay minimal or no income tax.

- Agricultural users may receive relief under special government schemes.

- Charitable organizations may qualify for exemptions if registered with authorities.

It is best to confirm eligibility by contacting GEPCO’s office.

Tips to Manage Gepco Income Tax Effectively

- Monitor your monthly electricity usage to avoid moving into higher tax brackets.

- Use energy-efficient appliances to lower consumption.

- Regularly check your bills online to track changes in income tax.

- Stay updated with government tax announcements in annual budgets.

Frequently Asked Questions (FAQs)

What is Gepco income tax on electricity bills?

It is a federal government tax collected through GEPCO bills, based on electricity usage and consumer type.

Why am I charged income tax if I already file returns?

Income tax through electricity bills applies universally. However, taxpayers can adjust or claim it in their annual tax return.

How can I verify Gepco income tax charges?

You can check your bill breakdown online via the GEPCO portal or third-party tools and compare with official tax slabs.

Can I get an exemption from Gepco income tax?

Yes, certain users like low-consumption households, agricultural consumers, or registered charities may qualify for exemptions.

How do I contact GEPCO about income tax disputes?

You can call helpline 118, email complaints@gepco.com.pk, or visit the nearest customer service office.

Understanding Gepco income tax is important for all electricity consumers under GEPCO’s jurisdiction. Since this tax is applied as part of federal policy, consumers must monitor their bills, verify charges, and contact GEPCO when necessary.

If you want to avoid surprises, regularly check your bills online, track usage, and stay updated about policy changes. For instant access to your latest bill, try Gepco Online Bill Check today.