Complete Guide to Iesco Tax Certificate (IESCO)

When it comes to managing electricity bills in Pakistan, the IESCO tax certificate plays a crucial role for both individuals and businesses. Whether you are a salaried person filing your income tax returns or a business ensuring proper documentation for tax deductions, this certificate is a key requirement. Many people are still unaware of what the IESCO tax certificate is, why it matters, and how to obtain it online without complications. This guide covers everything you need to know about the IESCO tax certificate, including its importance, the step-by-step process of obtaining it, and common FAQs answered for your ease.

What is an IESCO Tax Certificate?

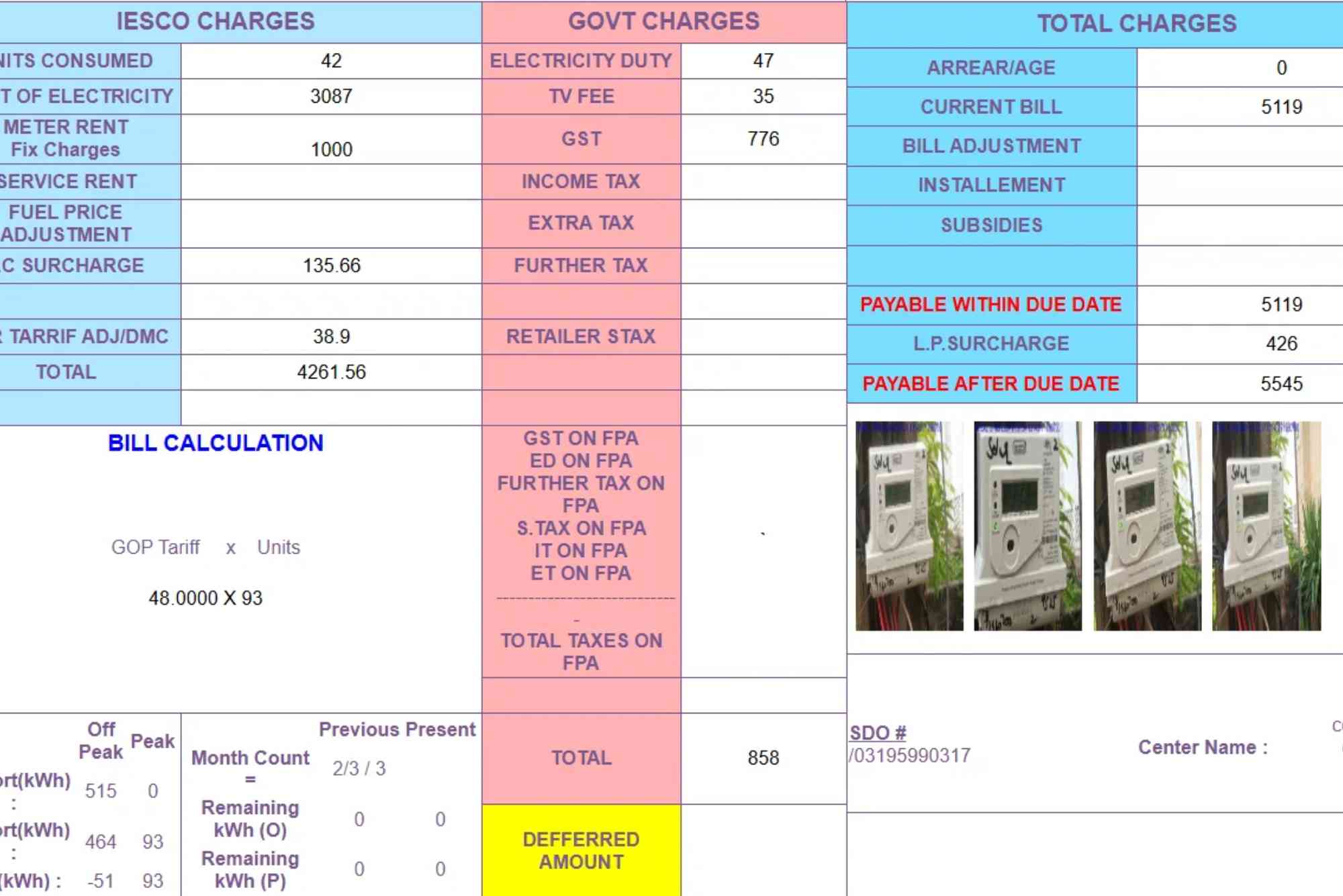

The IESCO tax certificate is an official document issued by the Islamabad Electric Supply Company (IESCO). It provides proof of the withholding tax deducted on your monthly electricity bills. Since electricity bills in Pakistan include withholding tax for registered and unregistered consumers, this certificate becomes an essential document for taxpayers. By collecting your IESCO tax certificate, you can claim tax deductions while filing your annual returns with the Federal Board of Revenue (FBR). Without it, salaried employees, business owners, and companies may miss out on eligible tax credits. Therefore, the certificate is not just a piece of paper; it is a formal confirmation that the tax you paid through electricity bills is recorded and verifiable.

Why is the IESCO Tax Certificate Important?

The IESCO tax certificate ensures financial transparency and strengthens your tax record. It allows you to justify tax payments already made through monthly utility bills, which helps reduce your overall tax liability. For individuals, it is a way to claim withholding tax adjustment while filing returns. For businesses, it helps maintain a documented trail of expenses and taxes, which auditors and tax authorities often require during annual audits. In simple terms, without this certificate, you may end up paying higher taxes than you actually owe. This makes it one of the most important documents for anyone who wishes to stay compliant with FBR regulations.

How to Obtain the IESCO Tax Certificate?

The process to get your IESCO tax certificate is straightforward, and IESCO has made efforts to digitize the system. You no longer need to visit the office physically or wait in long queues. Here is the simple way to download your tax certificate online.

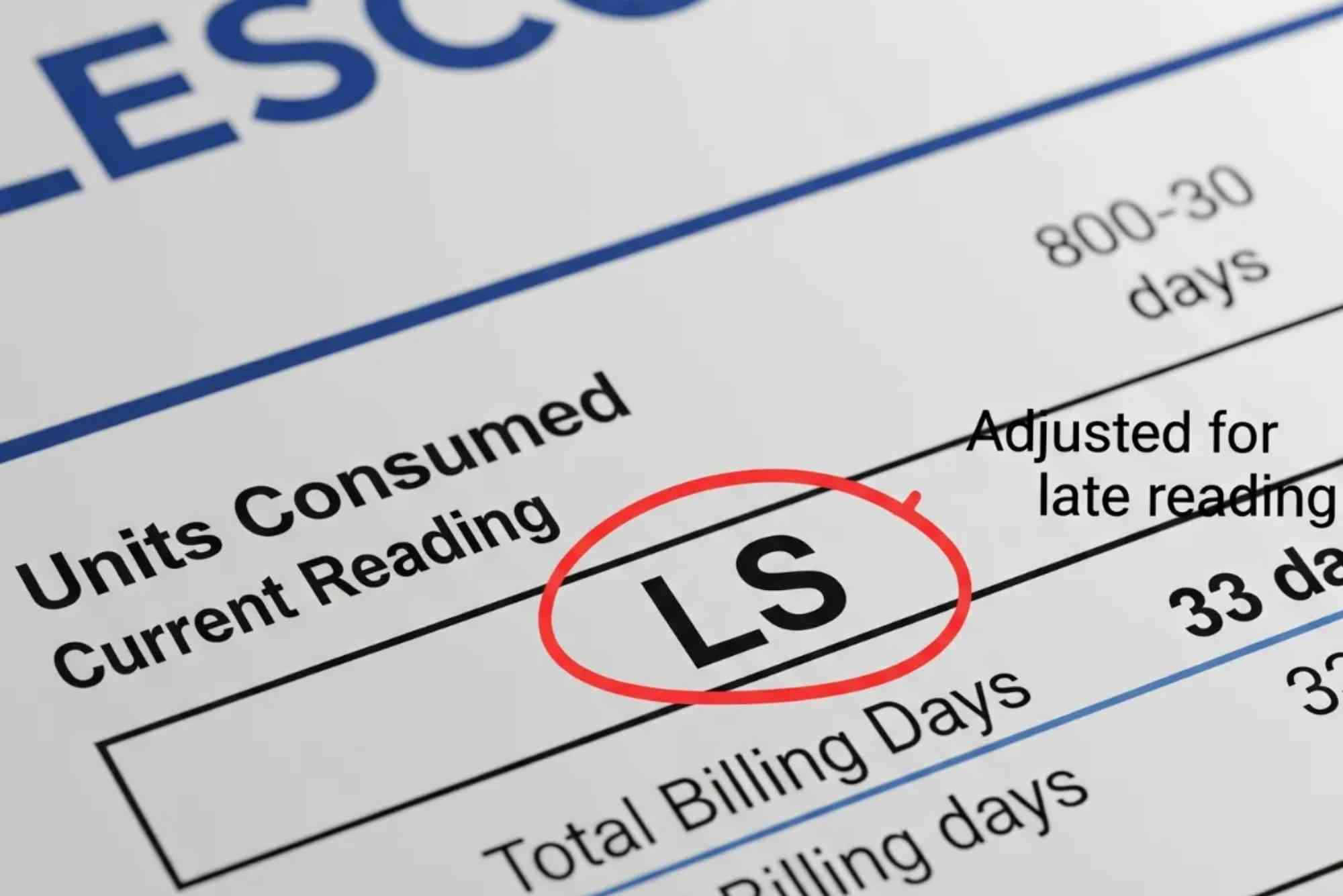

First, visit the official IESCO website or a trusted utility service portal. Enter your 14-digit reference number, which is printed on your electricity bill. After providing the required details, select the tax certificate option for the desired year. Within moments, your tax certificate will be available for viewing and downloading in PDF format. Once downloaded, you can use it for tax filing or keep it for your financial records. This system not only saves time but also makes the process accessible to people across Pakistan.

For consumers who may face difficulty while accessing the official portal, alternative trusted sources provide support for bill and tax-related queries. One helpful option is using services like IESCO Online Bill Check which allow you to quickly verify your bill details and access important tax information. Similarly, for other regions or general bill checking, the Online Bill Check platform is highly useful.

Step-by-Step Process for Downloading an IESCO Tax Certificate

To ensure smooth access, follow these steps carefully. Begin by checking your latest electricity bill to locate the reference number. Go to the official IESCO site, navigate to the tax certificate section, and enter your reference number. Choose the tax year for which you need the certificate. After verification, the certificate will be generated instantly. Save the PDF and, if necessary, print a copy for submission with your income tax return. This simple process ensures that you always have the required document at hand without delays.

Who Needs the IESCO Tax Certificate?

The IESCO tax certificate is essential for taxpayers across different categories. Salaried employees who wish to reduce their payable tax by adjusting withholding tax must submit it during their annual return filing. Business owners also need it for proper bookkeeping and for presenting accurate financial statements. Property owners, tenants running businesses, and commercial users of electricity also fall into this category. Even individuals who are not currently filing returns can benefit by maintaining their tax certificates, as it adds credibility to their financial record and prepares them for future compliance.

Common Issues Faced While Accessing the Certificate

Despite the convenience of online systems, users sometimes face technical issues. Some common problems include entering an incorrect reference number, site downtime due to heavy traffic, or downloading errors because of browser compatibility. In such cases, it is recommended to try again during off-peak hours or use a different browser. If the issue persists, contacting the IESCO helpline or visiting the nearest office may be necessary. Being aware of these issues beforehand can save you unnecessary frustration.

Tips for Managing IESCO Tax Certificates Effectively

To ensure hassle-free tax management, always keep your reference number safe and accessible. Download your certificate at the end of each tax year and store it in both digital and printed formats. Verify the entries on your certificate with the bills you have paid to avoid discrepancies. If you notice errors, contact IESCO immediately for rectification. Another important tip is to set a reminder before the annual tax filing deadline so that you do not forget to download the certificate in time. By following these tips, you will have a smoother experience in dealing with IESCO and FBR requirements.

Legal Importance of the IESCO Tax Certificate

From a legal perspective, the IESCO tax certificate is recognized as an official proof of tax payment. Under FBR guidelines, withholding taxes paid through utilities like electricity must be documented for adjustments. Failing to provide this document may result in rejection of your tax adjustment claim. Moreover, during audits, authorities often demand evidence of withholding tax paid. Having your IESCO tax certificate ready saves you from legal complications and ensures that your filings are accurate and acceptable under Pakistani tax law.

Frequently Asked Questions

How can I download my IESCO tax certificate online?

You can download it by entering your reference number on the official IESCO website and selecting the tax year.

Is the IESCO tax certificate mandatory for filing returns?

Yes, it is necessary if you want to claim adjustments on the withholding tax deducted through your electricity bills.

What if I cannot access the IESCO website?

If the website is down, try again later or use trusted platforms like IESCO Online Bill Check for verification and support.

Can I get the certificate for previous years?

Yes, you can select the required tax year while downloading the certificate online.

Do businesses also need IESCO tax certificates?

Yes, businesses need them for maintaining accurate tax and expense records during audits and filings.

What if my certificate has errors?‘

In case of discrepancies, you should contact the IESCO office or customer service immediately to correct the information.

The IESCO tax certificate is a vital document for anyone who pays electricity bills under Islamabad Electric Supply Company. It ensures transparency in your tax record, reduces your payable tax, and helps you comply with FBR regulations. With the digitized system, obtaining it is easier than ever before. By following the simple steps outlined in this guide, you can download your tax certificate in minutes and use it confidently during annual returns. Do not wait until the last moment; make it a habit to download and store your certificates regularly. If you want to manage your bills more efficiently, consider using tools like IESCO Online Bill Check and Online Bill Check to stay ahead in your tax and billing management. Take action today and secure your financial compliance with ease.