Everything You Need to Know About Lesco Income Tax Certificate

When it comes to managing your electricity bills in Pakistan, one essential document you may need is the Lesco income tax certificate. This certificate plays a key role in filing your annual income tax returns and ensuring compliance with government regulations. Many consumers often struggle to find, download, or understand its importance. This guide covers everything you need to know, from its purpose to the step-by-step process of obtaining it online.

What is a Lesco Income Tax Certificate?

The Lesco income tax certificate is an official document issued by the Lahore Electric Supply Company (LESCO). It shows the amount of income tax deducted from your electricity bills over a financial year. This certificate is essential for taxpayers because it helps in verifying tax deductions and claiming adjustments when filing income tax returns with the Federal Board of Revenue (FBR).

Why is the Lesco Income Tax Certificate Important?

The certificate is more than just a billing detail. It serves multiple purposes for consumers and taxpayers:

- Proof of Tax Payment: It confirms the income tax already paid through electricity bills.

- For Tax Filers: Helps individuals claim adjustments and avoid double taxation.

- Compliance Requirement: Required when submitting annual income tax returns.

- Financial Record Keeping: Acts as an official record for electricity-related tax payments.

If you’re a registered tax filer, obtaining this certificate ensures you do not miss out on tax credits.

How to Get Your Lesco Income Tax Certificate Online

LESCO has made it convenient for consumers to obtain the tax certificate online. Here is the process:

Visit the Official LESCO Website

Go to the LESCO official website and navigate to the tax certificate section.

Enter Your Reference Number

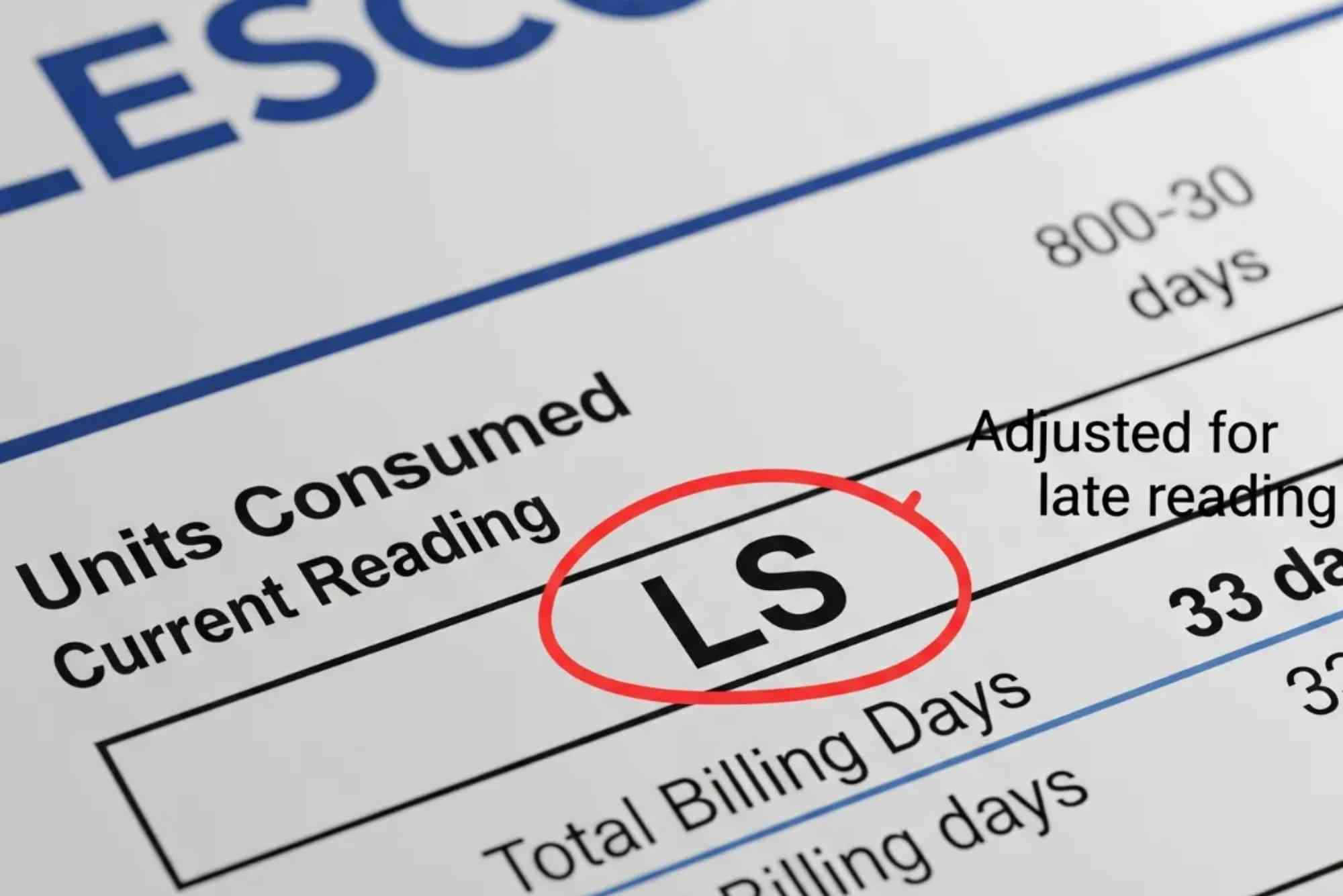

Your reference number is printed on your monthly electricity bill. Enter it carefully to avoid errors.

Select the Tax Year

Choose the financial year for which you need the certificate. Typically, this runs from July to June.

Download the Certificate

Once you submit your details, the system generates the certificate. Download and save it for your tax records.

Tip: Always double-check that the certificate reflects the correct consumer details and tax deductions.

Common Issues When Downloading the Certificate

Sometimes users face problems while downloading the certificate. These are the most frequent issues:

- Incorrect Reference Number: Always use the latest bill to ensure accuracy.

- Website Downtime: The LESCO site may experience high traffic during tax season.

- Browser Compatibility: Using outdated browsers may cause errors.

If issues persist, try accessing the website during off-peak hours or use a different browser.

How to Verify Your Lesco Income Tax Certificate

After downloading, it’s important to verify your certificate. Verification ensures the figures match the tax deducted from your bills.

- Cross-check the total deducted tax with your monthly bills.

- Ensure your consumer name and reference number are accurate.

- Confirm that the certificate corresponds to the correct tax year.

This verification process is crucial before attaching it to your tax filing documents.

Using the Certificate for FBR Tax Returns

When filing your tax return with FBR, the Lesco income tax certificate serves as supporting documentation. Attach the certificate in your return submission to claim the deductions. FBR uses this certificate to confirm that your taxes were already deducted at the source.

Benefits of Being a Tax Filer with LESCO

Tax filers enjoy reduced withholding taxes on their electricity bills. By registering with FBR and regularly filing returns, you benefit in the following ways:

- Lower tax rates on utility bills

- Eligibility for tax credits and refunds

- Legal compliance with Pakistan’s tax regulations

If you are not yet a filer, it is advisable to register with FBR to save money and avoid penalties.

Lesco Income Tax Certificate and Online Bill Services

LESCO has integrated its billing system with modern online tools. This makes it easier to manage bills and certificates. For instance, consumers can easily check their latest bills through Lesco Online Bill Check. Similarly, other electricity companies in Pakistan offer similar facilities that can be accessed via platforms like Online Bill Check.

Frequently Asked Questions (FAQs)

How can I download my Lesco income tax certificate?

You can download it from the official LESCO website by entering your reference number and selecting the tax year.

What is the use of the Lesco income tax certificate?

It serves as proof of tax deducted through electricity bills and is used for filing tax returns with FBR.

Do I need a separate certificate for each year?

Yes, you must download a separate certificate for every financial year.

Can I get my Lesco income tax certificate without being a filer?

Yes, non-filers can also download the certificate, but they pay higher withholding taxes.

Why is the reference number important?

The reference number uniquely identifies your electricity connection and is necessary for retrieving billing and tax details.

Does LESCO issue physical copies of the tax certificate?

LESCO generally provides the certificate online, but you can print it after downloading for official use.

The Lesco income tax certificate is a vital document for taxpayers in Pakistan. It ensures transparency in tax deductions and provides the necessary proof for income tax returns. By downloading and verifying this certificate annually, you stay compliant and avoid paying more than required.

If you haven’t checked your latest tax certificate yet, visit the LESCO online portal today and secure your records. Don’t forget to also keep track of your electricity bills through online services for convenience.

Stay on top of your electricity bills and tax documents. Download your Lesco income tax certificate now and make your tax filing process easier than ever.