When it comes to managing electricity bills in Pakistan, the Lesco Tax Certificate plays a crucial role for both residential and commercial consumers. Whether you are filing taxes or simply verifying your electricity payments, understanding this certificate ensures transparency and compliance. In this article, we will cover everything you need to know about Lesco tax certificates, including how to obtain one, its purpose, and online verification processes.

What is a Lesco Tax Certificate?

A Lesco Tax Certificate is an official document issued by the Lahore Electric Supply Company (LESCO) that confirms the amount of electricity tax paid by a consumer. It serves as proof for tax purposes and can be required for personal, business, or legal verification. Essentially, this certificate shows your electricity consumption and the taxes deducted, ensuring that all payments are properly documented.

Why the Lesco Tax Certificate is Important

The importance of a Lesco tax certificate cannot be understated. It helps consumers maintain financial transparency, especially for businesses that need to submit utility tax details for accounting purposes. Additionally, this certificate is often required when applying for government permits, filing income tax returns, or when verifying payments for audit purposes.

How to Obtain a Lesco Tax Certificate

Obtaining a Lesco tax certificate has become easier with online services, but the traditional offline method is still available. Consumers can request the certificate by submitting necessary details such as account number, CNIC, and payment receipts. LESCO provides these certificates either physically or digitally, making the process convenient for all users.

Online Process

With the rise of digital services, you can now apply for a Lesco tax certificate online. By visiting the official LESCO website, users can fill out a request form with their account details. After verification, the certificate is issued and can be downloaded in PDF format. This method reduces delays and ensures quick access to your tax information.

Offline Process

Alternatively, consumers can visit the nearest LESCO office to request the tax certificate. You will need to submit your CNIC and proof of electricity payments. The staff will verify the details and issue the certificate, usually within a few days. This method is ideal for those who are not familiar with online processes or prefer physical documentation.

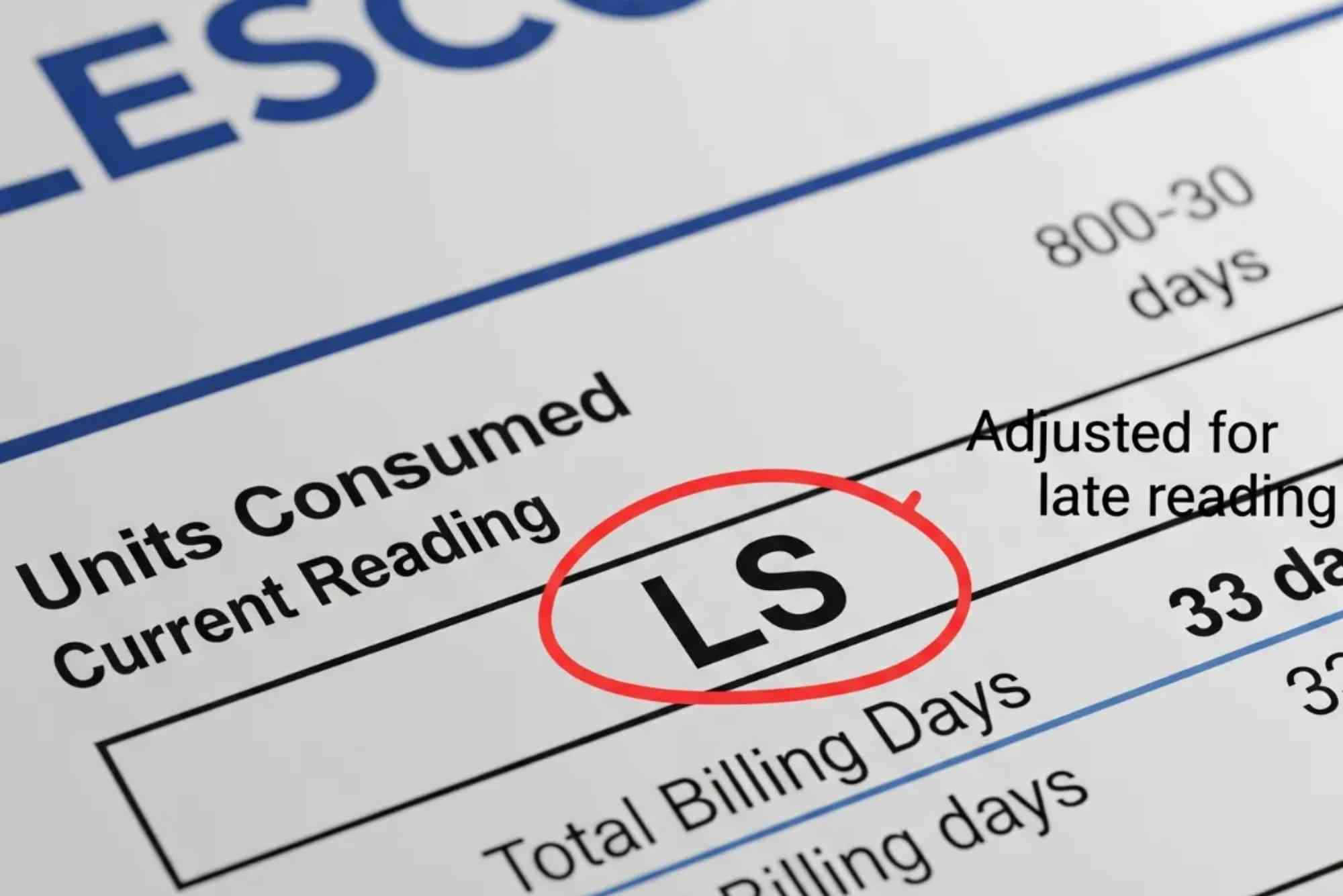

Key Information Included in a Lesco Tax Certificate

A Lesco tax certificate contains several important details that help verify electricity payments and taxes paid. These include the account number, consumer name, billing period, total electricity consumed, tax amount, and payment verification. Having this information in a certificate helps both consumers and businesses keep an organized record for accounting and auditing purposes.

Understanding Your Certificate

Reading the Lesco tax certificate carefully is essential. Each section provides clear information about your electricity usage and tax deductions. The certificate typically highlights the total tax amount separately to avoid confusion. Understanding this information ensures accuracy when using the certificate for official or tax-related purposes.

Benefits of a Lesco Tax Certificate

A Lesco Tax Certificate offers several advantages. First, it ensures that your tax payments are properly documented. Second, it simplifies the process of filing income tax returns by providing official proof of taxes paid. Third, it assists businesses in maintaining transparent accounts. Overall, this certificate promotes accountability and reduces the risk of errors in financial reporting.

For Businesses

For business owners, having a Lesco tax certificate is crucial. It provides evidence of electricity tax payments that can be used in financial audits. This document also helps businesses claim tax deductions and ensures compliance with government regulations.

For Individuals

Even for residential consumers, the certificate serves as proof of payment. It can be useful when applying for loans, verifying expenses, or resolving disputes regarding electricity bills. This makes the Lesco tax certificate a valuable document for personal finance management.

Common Issues with Lesco Tax Certificates

While obtaining a Lesco tax certificate is generally straightforward, some consumers encounter issues. Delays in certificate issuance, incorrect billing details, or mismatched account information are common problems. If you face any issues, contacting LESCO customer support or visiting the nearest office can resolve these problems efficiently.

Tips to Avoid Problems

Always ensure that your account information is up-to-date and that all payments are properly recorded. Using Lesco Online Bill Check tools can help you monitor your billing history and prevent discrepancies before requesting the certificate. Keeping a digital or physical record of payments also helps in smooth processing.

How to Verify a Lesco Tax Certificate

Verifying a Lesco tax certificate is important to ensure its authenticity. You can do this online through the LESCO portal or at local offices. By entering your account number and certificate details, the system confirms whether the document is valid. This verification step is particularly important for businesses that submit these certificates to government authorities.

Online Verification Tools

LESCO provides online services that allow consumers to track and verify their bills and certificates. Using tools like Online Bill Check, you can confirm your electricity usage, tax deductions, and payment history instantly. This reduces errors and helps maintain accurate records.

LESCO Tax Certificate and Legal Requirements

In Pakistan, electricity taxes are regulated, and proper documentation is required for compliance. The Lesco tax certificate ensures that consumers meet legal obligations and avoid penalties. For businesses, it is an essential part of financial reporting and audit compliance. Failure to produce a valid certificate may result in fines or additional verification requests from government authorities.

Government Compliance

The certificate acts as a formal acknowledgment that taxes on electricity bills have been paid. This makes it an indispensable document for tax authorities. Maintaining these certificates regularly ensures smooth tax filing and reduces disputes during audits.

Frequently Asked Questions (FAQs)

Q: How can I apply for a Lesco tax certificate online?

A: You can apply through the official LESCO website by providing your account number and CNIC. After verification, the certificate can be downloaded digitally.

Q: Is the Lesco tax certificate free of cost?

A: Generally, LESCO issues the certificate free for consumers who have paid all their bills. However, some processing fees may apply for offline requests.

Q: How long does it take to get a tax certificate?

A: Online requests are usually processed within 24–48 hours, while offline requests may take a few days depending on office workload.

Q: Can businesses use Lesco tax certificates for tax deductions?

A: Yes, businesses can submit the certificate as proof of electricity tax payments during accounting and audits.

Q: What if my Lesco tax certificate has incorrect details?

A: Contact the LESCO customer service or visit the local office to request corrections. Keeping updated billing information avoids such issues.

The Lesco Tax Certificate is more than just a document—it is proof of compliance, a tool for transparency, and an essential part of financial management. Whether you are an individual consumer or a business owner, understanding how to obtain and verify this certificate ensures smooth tax filing and proper record-keeping. Use online tools like Lesco Online Bill Check to monitor your bills and stay organized.

Take action today: ensure your electricity tax records are up-to-date and request your Lesco tax certificate to secure hassle-free compliance and accurate documentation. Staying proactive can save time, reduce errors, and make your financial management more efficient.