Everything You Need to Know About Lesco WHT Certificate

The Lesco WHT certificate is a crucial document for taxpayers in Pakistan who want to verify their Withholding Tax deductions on electricity bills. Whether you are a business owner, salaried person, freelancer, or domestic consumer, understanding the Lesco WHT certificate helps you manage your tax records, claim tax adjustments, and avoid yearly filing errors. Because tax compliance is becoming more important in Pakistan, learning how this certificate works can save you from unnecessary penalties and confusion. In this detailed guide, you will learn what the Lesco WHT certificate is, why it matters, how to download it, and how to use it properly during tax filing.

What Is a Lesco WHT Certificate?

A Lesco WHT certificate is an official tax deduction statement issued by the Lahore Electric Supply Company. It shows the exact amount of withholding tax charged on your electricity bill during a selected period. Since the Government of Pakistan uses withholding tax to document financial activity, this certificate becomes an essential record for anyone who files income tax returns. When you check or download your bill through digital portals such as the Lesco Online Bill Check page, you can later verify your tax deductions using the certificate. Taxpayers often overlook this document until filing season, but having it ready can make your tax process smoother.

Why the Lesco WHT Certificate Is Important for Tax Filers

The certificate matters because it is accepted by the Federal Board of Revenue as proof of deducted tax. If you are on the Active Taxpayer List, you can verify whether your tax was charged at the correct percentage. Non-filers pay a higher rate, so reviewing the certificate ensures accuracy. Filing your tax return without attaching proper WHT documentation may lead to discrepancies that trigger audits. Moreover, the certificate helps individuals calculate yearly expenses more transparently. Freelancers who often face documentation challenges also find this certificate helpful because it shows a consistent record of electricity usage and paid tax.

Who Needs a Lesco WHT Certificate?

The certificate is used by residential and commercial consumers who want accurate tax records. Business owners rely on it to manage accounts, while salaried individuals attach it with their FBR returns as part of expense documentation. Property owners with rental income also need it when tenants pay electricity bills under their CNIC. Anyone planning to claim a tax refund should maintain this certificate carefully. Even domestic consumers without a tax-filing requirement may need it for bank procedures or property documentation.

How to Download the Lesco WHT Certificate

Downloading the certificate requires basic bill information such as reference number or customer ID. While the Lesco website often works smoothly, many consumers prefer third-party portals for speed. You can visit platforms like Online Bill Check and enter your Bill Reference Number to access your billing details. After viewing your bill, you can use the same reference number during WHT certificate retrieval. Once you enter your details on the Lesco portal, the system generates a downloadable PDF for the selected month or year. Make sure your browser allows pop-ups so that the file appears correctly. If your certificate is not generated, you may need to refresh your connection or wait until off-peak hours.

What Information Appears on the Certificate

The certificate includes the consumer’s name, address, bill reference number, paid amount, and the exact WHT deduction. It also states whether the consumer was a filer or non-filer during the billing month, which affects tax percentage. The document contains official verification seals that make it valid for government departments. Every month on the certificate represents a separate tax deduction entry, and the annual certificate simply compiles all months into a single sheet.

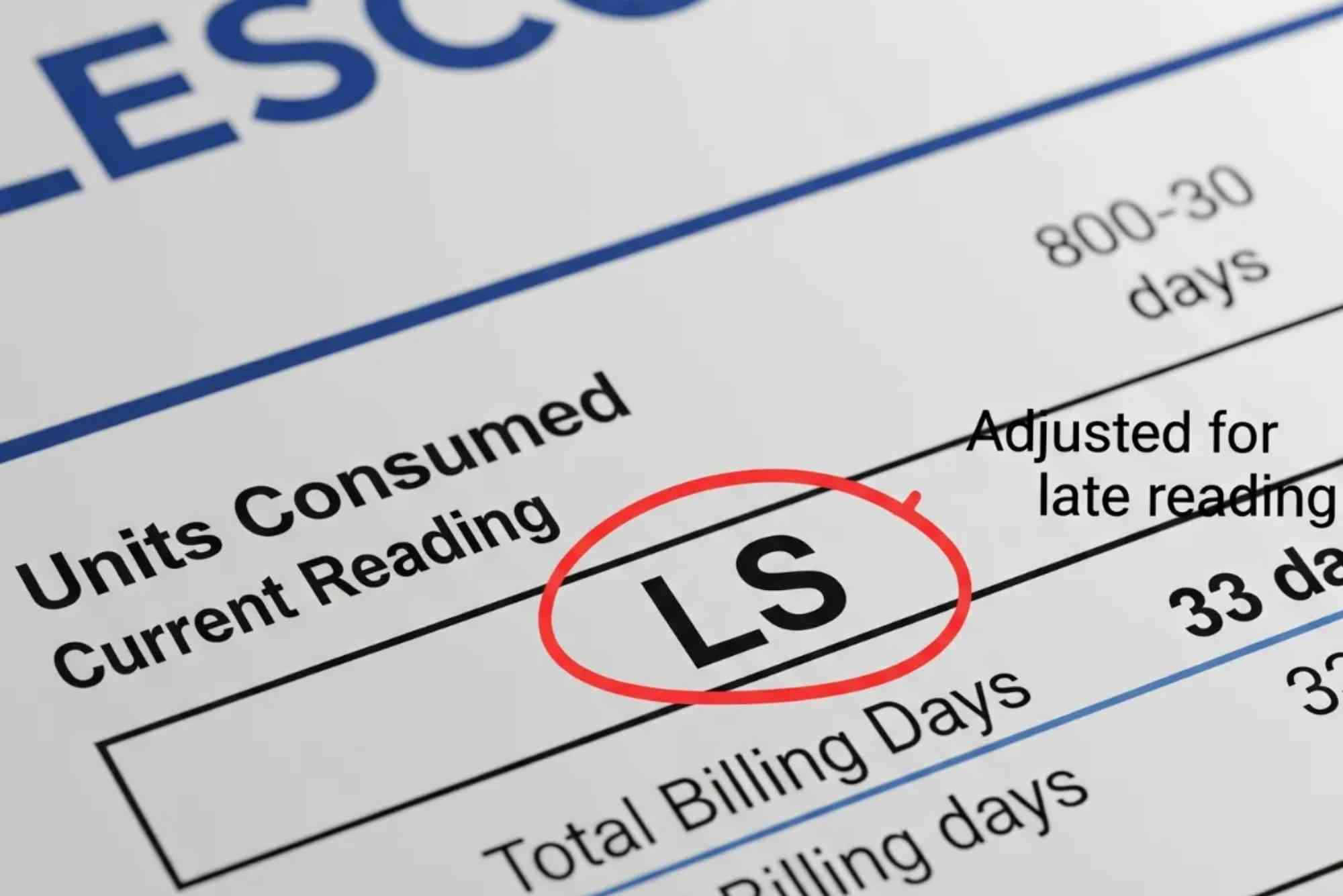

Understanding WHT Deduction on Your Lesco Bill

Withholding tax on electricity bills varies based on filer status and usage. If your monthly bill exceeds the government’s taxable threshold, tax is applied automatically. Filers usually pay a significantly lower percentage, which encourages consumers to stay active on the FBR list. By reviewing your Lesco WHT certificate, you can confirm whether the correct tax rate was charged. If you notice an error, you can contact the Lesco Customer Support Center with proof. Taxpayers often discover unnecessary deductions only when reviewing these certificates, which makes it a helpful document for financial monitoring.

Common Issues Users Face While Getting the Certificate

Consumers often face portal errors, especially during peak tax season. Sometimes the website takes longer to load or shows a blank page after entering the reference number. This usually happens due to server congestion. Another issue occurs when the consumer ID is outdated because of a connection transfer or name change. If your service record changed recently, you may need to update your profile with the nearest Lesco office. Slow internet connections can also interrupt the PDF download, so using a reliable browser and stable connection helps. If none of these solve the issue, you should visit a Customer Service Center with your latest bill and CNIC.

How to Use the Certificate for Tax Filing

Tax filers attach the Lesco WHT certificate with their income tax return as part of the annual deduction summary. When you enter your withholding tax under the “Electricity Bills” section in your FBR profile, you must ensure the amount matches the certificate. The tax year typically runs from July to June, so your annual WHT certificate should cover all months within that period. Freelancers and business owners who want to claim expenses against income can also use the certificate to support their tax calculations. Keeping a digital backup ensures you never lose your documents.

Difference Between Monthly and Annual WHT Certificates

A monthly certificate shows withholding tax only for a single billing cycle, while an annual certificate compiles the entire year. Many tax filers prefer the annual version because it provides a complete summary. However, banks and corporate audits sometimes ask for monthly certificates for detailed reviews. Both versions are equally valid, but the annual certificate is more convenient during income tax filing because it saves time.

Should You Download the Certificate Every Month?

It is not mandatory, but highly recommended. Keeping monthly certificates helps you track electricity usage and taxes throughout the year. If you wait until tax season and the portal goes down, you might face delays. Regularly saving PDF copies also helps if you need to provide documentation to a landlord, employer, or audit team. Storing them in cloud folders like Google Drive or Dropbox ensures long-term safety.

How Lesco WHT Certificates Benefit Businesses

Businesses with multiple commercial meters must maintain accurate tax records for legal compliance. The Lesco WHT certificate becomes a vital document in financial audits. It helps verify electricity expenses, tax deductions, and billing accuracy. Businesses also use the certificate to compare consumption across different branches. Since withholding tax affects yearly profit calculations, maintaining these certificates protects the business from tax penalties. If your company undergoes a tax inspection, the absence of these certificates can create serious compliance issues.

How to Verify the Authenticity of Your Certificate

Every certificate contains unique identifiers issued by Lesco. The QR code and digital stamp validate the document. If your certificate looks altered or incomplete, you should re-download it from the official portal. Some consumers mistakenly use screenshots of bills instead of actual certificates, which FBR does not accept. Make sure the PDF includes complete tax details and the official verification mark. You can also cross-check tax amounts with your bill history through the Lesco Online Bill Check system to confirm accuracy.

Keep Your Tax Records Clean and Updated

Understanding the Lesco WHT certificate helps you maintain accurate tax documentation and avoid filing mistakes. Whether you file taxes as a business owner or individual, this certificate is essential for compliance. You can easily verify your billing information and tax deductions using platforms like Lesco Online Bill Check or explore fast options through Online Bill Check to stay updated with your records. Keeping your certificate ready ensures a smooth tax filing experience.

FAQs

What is a WHT certificate in electricity bills?

It is a document showing the withholding tax deducted by the electricity provider for a specific period. Lesco issues this certificate for its consumers.

How can I get a Lesco WHT certificate online?

You enter your bill reference number on the Lesco portal, select your required month or year, and download the PDF.

Why does Lesco charge withholding tax?

Lesco collects withholding tax on behalf of the Government of Pakistan to document taxable activity and encourage tax compliance.

Can I claim the withholding tax deduction in my tax return?

Yes, if you file your income tax return, you can claim the deducted amount using the Lesco WHT certificate as proof.

Is WHT deducted from every electricity bill?

It applies only if the bill crosses the government’s taxable threshold or if the consumer is a non-filer.